We have recently received a verification request from the owner of Investfundsonline.com, seeking a higher Trust Score on ScamAdviser.com. As of now, the website’s Trust Score is alarmingly low, standing at 13/100, and it has raised suspicions due to the presence of questionable reviews, suggesting potential untrustworthiness.

Upon conducting a thorough manual investigation into Investfundsonline, several warning signs have emerged, pointing towards the possibility of it being a fraudulent investment scheme. One particularly startling revelation is that Investfundsonline is registered with the Australian Securities & Investments Commission (ASIC) under the name IFO GROUP PTY LTD (ACN: 655 999 590), despite the considerable risks it poses to investors.

What is ASIC?

As per Wikipedia, the Australian Securities and Investments Commission (ASIC) is an autonomous commission of the Australian Government with the primary responsibility of serving as the national corporate regulator. Its key role involves overseeing company and financial services, as well as enforcing laws to safeguard Australian consumers, investors, and creditors.

Nevertheless, a deeper exploration into Investfundsonline’s business model and offerings raises doubts about ASIC’s effectiveness in fulfilling its fundamental mission of protecting consumers from financial fraud. This is because the company’s ASIC registration plays a significant role in convincing potential investors that they can trust the company. Despite this concern, our attempts to seek clarification from ASIC regarding how such a company obtained registration have gone unanswered. In the following sections, we will delve into the reasons why it is troubling that Investfundsonline was able to attain an ASIC registration.

Is Investfundsonline.com a Scam?

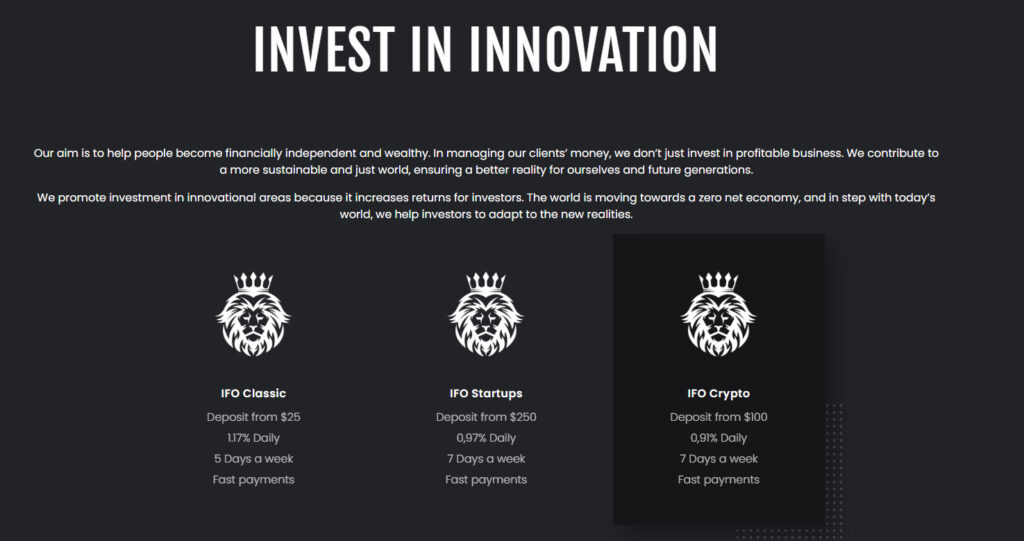

Investfundsonline presents itself as an ‘investment company’ that purportedly generates profits for investors through stock and cryptocurrency trading. Interestingly, it offers three investment plans labeled as ‘products,’ with remarkably low minimum deposit amounts ranging from $25 to $100, while promising incredibly high daily returns of 1.17% to 0.91%.

The concept of offering higher returns for smaller deposits contradicts the norm observed in legitimate investment opportunities. Typically, genuine investments offer higher returns for larger investment amounts, providing a higher return on investment (ROI).

The use of the term ‘products’ for their investment plans appears to be an attempt to mimic the structure of Multi-level Marketing (MLM) companies. While MLM is a legal business model, caution has been advised due to the presence of MLM Scams, which operate fraudulently under the guise of legitimacy. In contrast to legitimate MLM companies that offer tangible products or services, Investfundsonline solely provides investment packages without any underlying product or service, resembling more of a pyramid scheme than an MLM.

Upon further investigation, several indicators point to Investfundsonline possibly functioning as a covert pyramid scheme. The company refers to investors as ‘distributors’ and heavily emphasizes team building, which often acts as a euphemism for creating a downline.

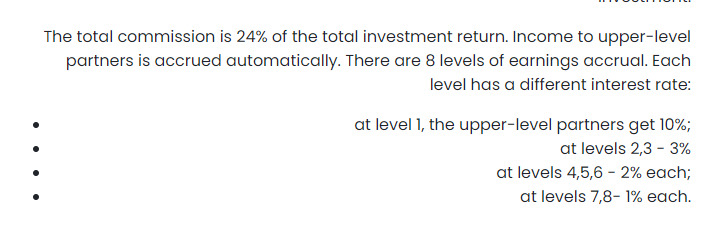

In addition to the extravagant promised ROI from their ‘products,’ Investfundsonline places significant emphasis on establishing an ‘affiliate network,’ which essentially translates to a downline structure. The company implements an 8-tier referral commission system, rewarding investors with up to 24% additional returns when their referrals make a deposit. Such referral commissions are a characteristic strategy employed by pyramid schemes.

Is the Company Information of Investfundsonline Fake?

One of the primary factors contributing to trust in a company is the integrity of its leadership. Therefore, it becomes essential to scrutinize the management team of Investfundsonline and ascertain if it is comprised of trustworthy individuals.

The public face representing Investfundsonline is introduced as ‘Thomas Lyons,’ who supposedly holds the position of CEO within the company. This name is also listed in the domain registration details.

However, upon closer examination, a red flag arises. The registrant’s address mentioned in the domain registration is ‘Lang Road 96,’ which does not appear anywhere on the company’s website. Curiously, this address turns out to be a residential one, raising suspicions about its connection to Investfundsonline. A legitimate company’s CEO would never use their personal address for domain registration, implying that the given address is likely unrelated to the company.

Furthermore, attempts to find information about Thomas Lyons online have proven fruitless. He lacks any presence on professional platforms like LinkedIn, and there is a noticeable absence of real Investfundsonline employees on LinkedIn as well.

A video titled ‘Thomas Lyons CEO IFO’ can be found on Investfundsonline’s YouTube channel, where Thomas Lyons is seen and heard speaking. Notably, despite being purportedly an Australian company, Thomas Lyons does not possess an Australian accent. This raises suspicions that Thomas Lyons could potentially be a paid actor rather than the actual CEO of Investfundsonline.

The lack of verifiable information and the presence of questionable details surrounding Thomas Lyons and the company’s leadership cast doubt on the credibility and transparency of Investfundsonline’s management team.

Is Investfundsonline Lying About the Company’s Age?

Another inconsistency arises from the video titled ‘Mike Collins Trader IFO,’ featured on Investfundsonline’s platform. In this video, an individual named ‘Mike Collins’ asserts that he has been trading on Investfundsonline since 2019.

However, upon further investigation, no evidence can be found to support the existence of Investfundsonline before December 2021. Snapshot records from the Internet Archive clearly demonstrate that Investfundsonline did not commence its operations before March or April 2022. Below are snapshots from December 2021 and April 2022 for reference.

Curiously, Investfundsonline’s own website explicitly states that the company was registered in December 2021, directly contradicting Mike Collins’ claim of having used the platform since 2019. As a result, it raises suspicions that Mike Collins might also be a paid actor, further casting doubts on the authenticity and credibility of Investfundsonline.

Suspicious Review Pattern

Like many MLMs and Pyramid Schemes, Investfundsonline appears to have a plethora of positive online reviews, primarily because ‘investors’ are encouraged to promote the platform to gain referral benefits. For instance, on Trustpilot, Investfundsonline boasts a flawless 100% 5-star rating. However, upon closer examination of these reviews, they exhibit telltale signs associated with pyramid schemes, such as the presence of referral links, enticing promises of ‘passive income,’ and an unwarranted sense of unwavering optimism.

Despite Investfundsonline’s attempts to present itself as operating since December 2021, it becomes evident that the site only went live approximately in March 2022. The earliest reviews for Investfundsonline, dated March 21st, 2022, are written in Russian, hinting at a potential origin of the pyramid scheme from Russia. This raises concerns about the legitimacy and intentions of Investfundsonline, considering its association with such a country renowned for hosting dubious financial schemes.

Conclusion

Due to the reasons mentioned in this article, it is alarming to see that the Australian Securities & Investments Commission is putting consumers at risk by awarding registrations to companies that do not pass even the simplest ‘smell test’.

In fairness, an AFS license is required for any business providing financial services to operate in Australia, which Investfundsonline does not seem to have. However, the fact that they have a genuine ASIC registration and portray the company as an MLM is enough to sway the minds of consumers who end up investing hard-earned money into potentially unsustainable and fraudulent investment schemes.

Add comment