Cryptocurrency price volatility has been a defining characteristic of the digital asset market since its inception. The remarkable swings in prices, often within short time frames, have drawn both intrigue and caution from investors and observers worldwide. This volatility, characterized by rapid and significant price fluctuations, forms the cornerstone of the crypto landscape. Understanding its roots and implications is pivotal for anyone involved in this evolving financial realm. In this exploration, we’ll unravel the intricate tapestry of factors that contribute to this volatility, examining the market dynamics, technological influences, regulatory shifts, and external events that collectively shape the tumultuous nature of cryptocurrency prices.

The concept of volatility in cryptocurrencies extends far beyond mere financial metrics; it embodies the ethos of a market driven by innovation, speculation, and rapid technological advancements. Unlike traditional financial instruments, where volatility often reflects risk, in the crypto sphere, it signifies both opportunity and challenge. The interplay between demand and supply dynamics, speculative fervor, technological breakthroughs, and regulatory landscapes forms an intricate web, where the slightest ripple can trigger massive price movements. This volatility isn’t just a consequence of market inefficiencies but rather a reflection of a nascent yet dynamic ecosystem continually navigating uncharted waters.

As we dissect the layers of cryptocurrency volatility, it becomes evident that its roots extend beyond the digital realm. From sudden market swings triggered by regulatory announcements to price surges fueled by social media buzz, the crypto market dances to the tunes of a myriad of external factors. Its susceptibility to manipulation, the impact of high-profile security breaches, and the influence of global geopolitical events further accentuate the sensitivity of cryptocurrency prices. In this volatile landscape, where traditional financial theories often find themselves challenged, lies an ecosystem teeming with both potential and uncertainty, shaping the future of finance in unprecedented ways.

Understanding Cryptocurrency Price Volatility

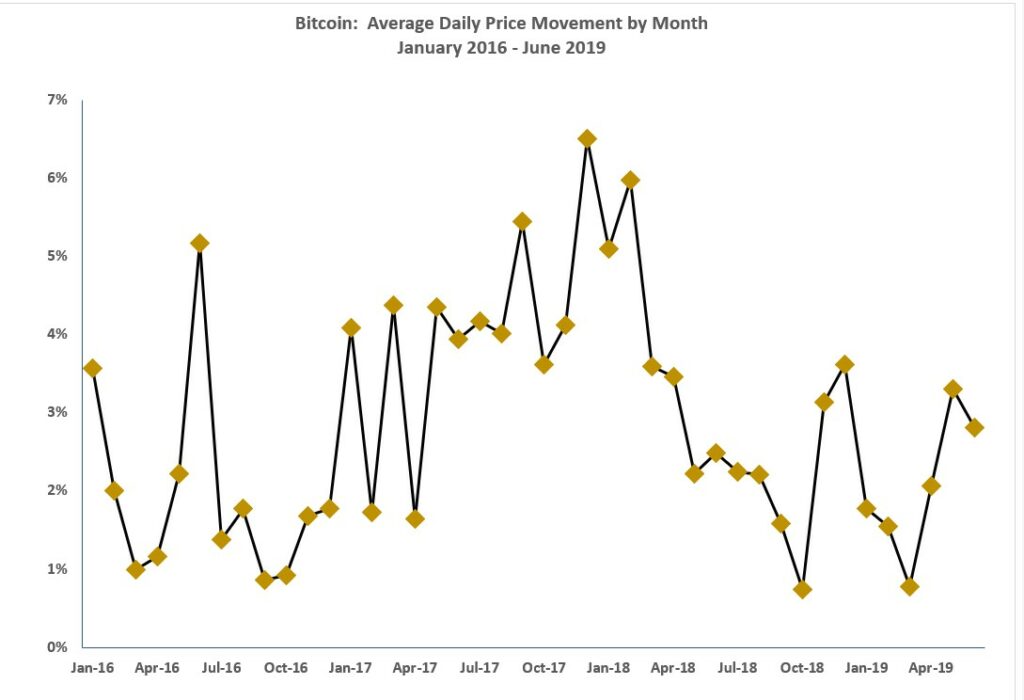

Volatility within the realm of cryptocurrencies represents the inherent unpredictability and fluctuation in their prices over time. It’s commonly measured by statistical tools like standard deviation or variance, gauging the dispersion of price data points from the mean. Unlike traditional assets, cryptocurrencies exhibit a unique form of volatility, often characterized by intense short-term fluctuations. This volatility index isn’t just a measure of risk but also a reflection of the market’s rapid response to various stimuli, encompassing both positive and negative sentiments that drive price movements.

Comparing the volatility of cryptocurrencies to traditional assets unveils a stark contrast in their behavior. While conventional markets such as stocks, bonds, or commodities do experience fluctuations, the degree of volatility within the crypto space tends to surpass these benchmarks. Cryptocurrencies, due to their relatively nascent stage and speculative nature, often witness dramatic price swings within a matter of hours or even minutes. This heightened volatility, sometimes seen as a deterrent to traditional investors, simultaneously offers opportunities for substantial gains. The difference in volatility between the two realms highlights the evolving nature of digital assets, where factors like market sentiment, technological advancements, and regulatory shifts play outsized roles in shaping price movements.

Factors Influencing Cryptocurrency Price Volatility

The ebb and flow of cryptocurrency prices are significantly influenced by market dynamics, chiefly the interplay between demand and supply. Liquidity and trading volume act as vital metrics, indicating the ease with which a cryptocurrency can be bought or sold without causing drastic price movements. Higher liquidity tends to stabilize prices, whereas lower liquidity often leads to more substantial price swings, amplifying volatility. Alongside liquidity, market sentiment and speculation form another significant driver of price volatility. The collective mood of investors, influenced by news, social media buzz, or even rumors, can trigger buying or selling sprees, rapidly altering prices and amplifying market volatility.

Technological advancements and regulatory developments stand as pivotal influencers in the crypto landscape. Technological breakthroughs like upgrades to blockchain networks or the introduction of novel consensus mechanisms often generate considerable market excitement, causing price fluctuations. Similarly, regulatory news and shifts in governmental attitudes towards cryptocurrencies wield immense power over prices. A single announcement or change in regulatory stance can spark sharp price movements, reflecting the market’s sensitivity to regulatory factors. Furthermore, market manipulation by large holders and external events such as hacks, security breaches, or geopolitical tensions can severely impact cryptocurrency prices, leading to heightened volatility as the market reacts to these unexpected occurrences.

Case Studies and Examples

The crypto market has witnessed several instances of extreme volatility, often etched into its history. The 2017-2018 bull run exemplifies such volatility, where Bitcoin, the flagship cryptocurrency, surged from around $1,000 to nearly $20,000 within a year, only to experience a subsequent crash, dropping to around $3,000 in 2018. Another notable event occurred in May 2021 when Elon Musk’s tweets about Bitcoin triggered a market frenzy, leading to a rapid decline in its value by over 30% in a short span. These instances underscore the susceptibility of cryptocurrencies to sharp and sudden price movements, significantly impacting investor sentiments and market dynamics.

Analyzing specific cryptocurrencies reveals distinct volatility patterns. Ethereum, for instance, often mirrors Bitcoin’s movements but with heightened volatility due to its role as a platform for various decentralized applications (dApps) and smart contracts. Altcoins, on the other hand, often exhibit more exaggerated price swings compared to established cryptocurrencies like Bitcoin and Ethereum, primarily due to their smaller market caps and greater susceptibility to market sentiment. Understanding these volatility patterns aids investors in devising informed strategies tailored to the behavior of specific cryptocurrencies.

Managing and Mitigating Volatility

In navigating the volatile crypto market, implementing effective risk management strategies becomes paramount. Techniques like setting stop-loss orders, which automatically sell assets at predetermined prices to limit losses, and employing proper position sizing to manage risk exposure are crucial for investors and traders. Additionally, diversification across different cryptocurrencies and asset classes can help spread risk and reduce the impact of volatility on an investment portfolio. Hedging strategies, such as options or futures contracts, also offer avenues to mitigate potential losses in times of market turbulence.

Diversification further extends to stablecoins, a category of cryptocurrencies pegged to stable assets like fiat currencies or commodities. Stablecoins serve as a hedge against volatility, allowing investors to park their assets in a more stable form during turbulent market conditions. They provide a haven from the price fluctuations inherent in other cryptocurrencies while still retaining the advantages of blockchain technology and the ease of transfer associated with digital assets. Understanding and utilizing stablecoins strategically can serve as an effective tool in managing and mitigating the overall volatility within a diversified crypto portfolio.

Conclusion

In the labyrinthine world of cryptocurrencies, price volatility stands as a defining characteristic, shaping the landscape and dynamics of this burgeoning market. The complex interplay of factors driving this volatility, from market sentiment and technological advancements to regulatory shifts and external events, underscores the intricacies and uncertainties inherent in the crypto sphere. Volatility, far from being a mere metric of risk, embodies the essence of a market teeming with both potential and unpredictability, where fortunes can be made or lost within moments.

As we gaze upon the historical backdrop of extreme volatility, from the meteoric rise and subsequent crash during the 2017 bull run to the seismic shifts triggered by individual influencers’ tweets, it becomes evident that the crypto market remains highly susceptible to sudden and drastic price swings. The analysis of specific cryptocurrencies unveils diverse volatility patterns, underlining the importance of understanding each asset’s unique behavior for informed investment strategies. Moreover, the comparison with traditional financial markets accentuates the unparalleled nature of crypto volatility, delineating a realm where technological innovation, speculative fervor, and external influences wield immense power over prices.

Effectively managing and mitigating volatility emerges as a critical skill for participants in the crypto market. Employing risk management strategies, embracing diversification, utilizing hedging mechanisms, and strategically incorporating stablecoins all serve as vital tools in navigating the tumultuous waters of crypto price volatility. As this space continues to evolve and mature, the comprehension and adept handling of volatility will remain pivotal, offering both challenges and opportunities for investors and stakeholders alike. Embracing this volatility as an inherent facet of the crypto ecosystem while leveraging strategies to harness its potential represents a paradigm shift in the realm of finance, propelling us into a future where volatility is not just endured but harnessed for growth and innovation.

Add comment