A rugpull: the one thing investors fear the most in crypto. Yet, the words of Marvel’s supervillain, Thanos rings true:

“Dread it, run from it, destiny arrives all the same.”

However, unlike the inevitable devastating effects of the infinity stones, a rugpull can be avoided – you just have to identify the signs on time.

So, how can you tell if a project is on the path to a rugpull? And how do you get out before shit hits the fan?

The codes Never Lie

Say all you want about the regulation of cryptocurrencies or the lack thereof, but it’s all laid out in 0s and 1s – not black and white.

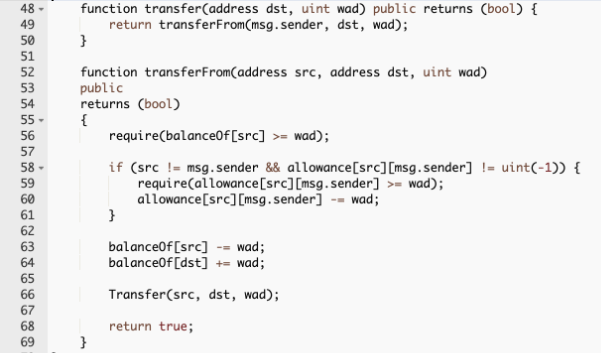

If it’s a De-Fi project, the smart contract codes tell it all. You can tell if the project is here for the long term by looking at the smart contract codes.

If the contract has unverified codes, run. Those are usually done to keep unruly activities from the prying eyes of the community. For instance, a project with a capped token supply that has a minting function is a rekt-haven for investors.

You should also lookout for an ownership renounced contract. Projects that allow a contract owner to decide who gets what and how are certainly not to be trusted.

Liquidity locking and time lock also help you to identify projects that have intentions of pulling the rug from under your feet. If liquidity isn’t locked for a few months, the team isn’t keen on building.

Tokenomics Is the Key

All projects on the blockchain have their tokenomics. If they have a native token, the tokenomics serves as a guide on its use and misuse.

If you’re dealing with a potential rekt project, tokenomicsisn’t just about token distribution; it paints the true picture of the intention of the project. Likely candidates for rugpull don’t put any value on their token. It’s mostly marketing, burning, and sharing. If tokenomics points this out, it’s your clue to take caution.

Know TheDevs

It’s common for blockchain developers to hide under the cloak of anonymity should in case things go south. Yet, that gives them the leeway to leave investors dazed with a rugpull. Projects that have Devs with a name and face are rare gems.

There are ways to confirm a project’s devs are going to be pulling the plug anytime soon. If they’re not accountable to the community, that’s a big red flag.

A lack of communication is another sign the Devs don’t care about the project. Reassurances are crucial in the unregulated crypto space. If the team – Dev team especially – doesn’t see a need to spoon-feed investors on the state of the project, then you should manage your risk accordingly.

Is it real