Many trading gurus are known to insinuate negative funding rates are the best time to buy bitcoin. How true are these claims?

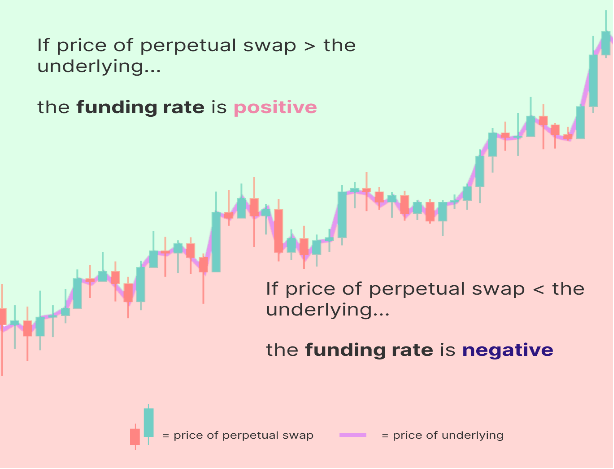

The funding rate referenced refers to the rates applied when perpetual contracts are opened. The variation in leverage taken decides if the funding rate is positive or negative. For a negative funding rate, sellers take up more leverage as against those of buyers.

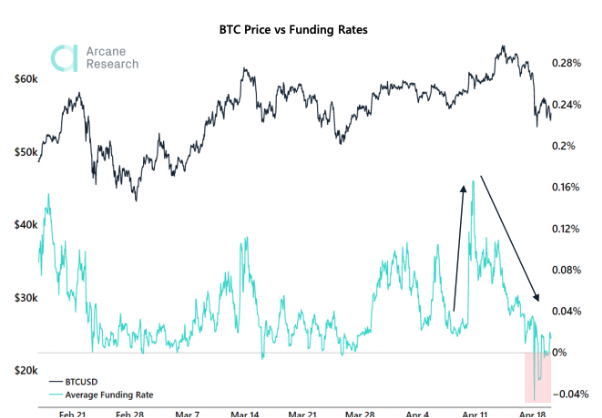

For these trading gurus, the funding rate for bitcoin – which has been negative for over a month – is a clear indication of a buying signal. This is despite the drop in enthusiasm by those notorious for their leverage longs.

There’s some history backing the negative funding rate claim. In 2020, when the pandemic was in full swing, sellers were leading the leverage charge as bitcoin and other cryptocurrencies were shorted during this period.

Prices were comparatively cheap, which is seen as a buying opportunity.

The pattern appears to be taking shape in 2021, which explains why lots of trading pros have linked these negative funding rates to buying signals.

The catch with this funding rate-buying signal connection is the realization that a negative funding rate could continue for long spells, which poses the question of the best time to get your hooks out.

Knowing when to set that buy order is all about using the duo of funding rate and the spot market interplay the right way. It’s not reliant on perpetual contracts. The spot market needs to be considered as well.

One of the ways to identify a good buy signal is knowing the bottom. Yet, it’s too early to identify the bottom due to the irrational behaviour of the sentiment-driven market.

Currently, knowing when the market will recover or what is expected to change the general sentiments of buyers positively is impracticable.

Any trader struggling with the current market situation stands a better chance by longing a percentage of their portfolio when the market price hits any of the lower supports. It’s a more profitable strategy than out rightly shorting.

Humm que legal ameii

Oh ok