Introduction

Non-fungible tokens (NFTs) have taken the digital world by storm, with people buying and selling them for millions of dollars. However, concerns have been raised about the legitimacy of NFTs, with some critics calling them a ponzi scheme. This article will explore the concept of NFTs, the concerns about them being a ponzi scheme, and whether they are inherently fraudulent.

While some NFTs are undoubtedly created and marketed in a ponzi-like manner, not all NFTs fall into this category. Therefore, the thesis statement of this article is that while NFTs are not inherently a ponzi scheme, some are created and marketed in a ponzi-like manner.

What are NFTs?

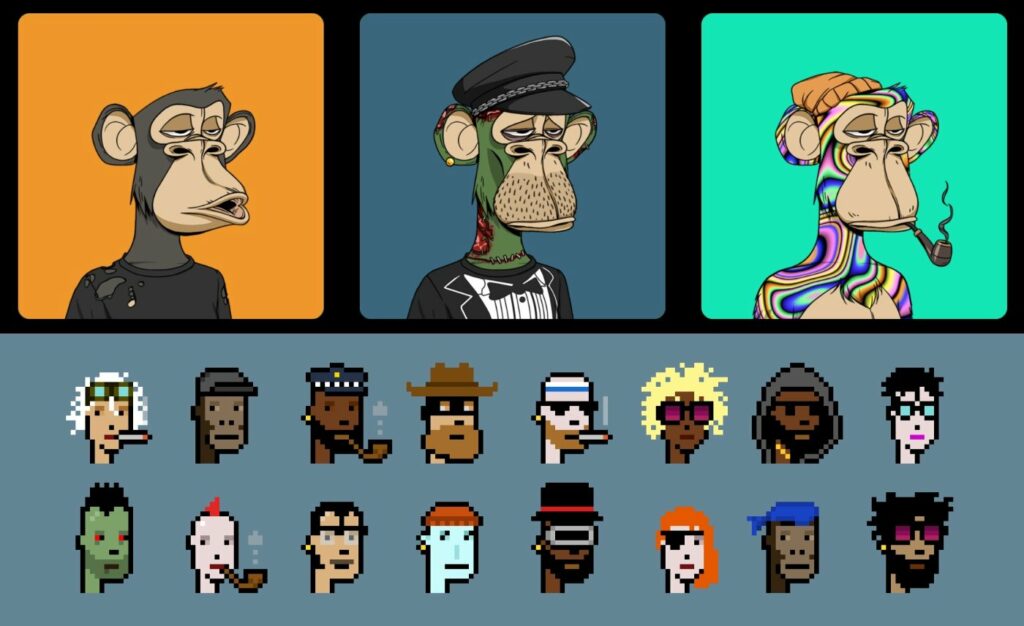

NFTs are unique digital assets that are bought and sold on blockchain platforms. Each NFT is unique, making it impossible to exchange one NFT for another, hence the term “non-fungible”. NFTs can be anything from digital art, music, or videos, to virtual real estate, sports collectibles, and more. They are created using blockchain technology, which ensures their authenticity and uniqueness.

NFTs have been used to solve issues of digital ownership, by allowing creators to sell their digital works and ensure they get credited and paid for their creations. Additionally, buyers of NFTs can prove that they own a unique digital asset, which can be valuable in certain contexts, such as for collectors or investors.

How NFTs can be a ponzi scheme

While NFTs can have legitimate uses, they can also be used to create and market a ponzi scheme. One way this can happen is by overvaluing the NFTs, causing buyers to invest large sums of money in the hopes of reselling them at a profit. This is similar to a classic ponzi scheme, where investors are lured in with promises of high returns.

Another way NFTs can be used as a ponzi scheme is by pumping and dumping them. This is where an NFT is promoted aggressively, causing its value to skyrocket, and then the creators or initial investors sell their holdings, causing the value to plummet.

NFTs can also be created with false scarcity, artificially limiting the number of NFTs available to drive up their value. This can be achieved by only creating a limited number of NFTs or by promoting them as one-of-a-kind, despite being near-identical to other NFTs.

Finally, misleading marketing tactics can be used to promote NFTs, such as false claims about their value or rarity. These tactics can deceive buyers into investing in NFTs that have little actual value.

Not all NFTs are a ponzi scheme

While some NFTs are created in a ponzi-like manner, not all NFTs are fraudulent. Some NFTs have genuine artistic or cultural value and are created and marketed transparently and ethically. Additionally, NFTs can provide benefits to both creators and buyers, such as allowing creators to monetize their digital creations and providing buyers with a unique digital asset.

For example, an NFT can provide a musician with royalties and credit for their digital music, or a visual artist with a way to sell their digital art without the risk of piracy. Additionally, buyers of NFTs can prove that they own a unique digital asset, which can be valuable in certain contexts, such as for collectors or investors.

Addressing the concerns about NFTs

It is important to address the concerns about NFTs being a ponzi scheme to ensure the long-term viability and legitimacy of the NFT market. One way to address these concerns is through increased transparency and regulation. Platforms that sell NFTs could be required to disclose information about the creator, the authenticity of the NFT, and any previous sales or valuations. Additionally, education for creators and buyers could help to ensure that NFTs are being created and marketed in an ethical and transparent manner.

Another way to address concerns about NFTs being a ponzi scheme is to shift the focus away from hype and speculation and towards the actual value and use cases of NFTs. While some NFTs may be marketed as investments or status symbols, many NFTs have genuine artistic or cultural value. By emphasizing the unique features and benefits of NFTs, creators and buyers can be encouraged to engage with the market in a more sustainable and ethical way.

Conclusion

In conclusion, while NFTs are not inherently a ponzi scheme, some are created and marketed in a ponzi-like manner. It is important for the NFT market to address these concerns through increased transparency, education, and a focus on the genuine value and use cases of NFTs. By doing so, the NFT market can continue to grow and evolve in a sustainable and legitimate way, benefiting both creators and buyers alike.

Add comment