Since the launching in 2015, Ethereum has been an open-source, blockchain-based, decentralized computing framework used for its cryptocurrency, ether. It allows Smart Contracts and Distributed Applications to be developed and run without any downtime, fraud, control, or intervention by third parties.

It’s not only a platform but also a programming language (Turing complete) running on a blockchain, allowing developers to create and publish distributed applications.

Reasons why you should mine Ethereum.

Mining transforms the act of securing a network into a complicated but typically very profitable business, so earning money is the primary motive for mining. Miners will receive a certain payment for each block, plus any transaction fees charged by users. Generally, commissions make a minimal contribution to net income, but the decentralized finance boom in 2020 helped to shift the calculus for Ethereum.

There are other reasons why anyone would want to mine Ether. An altruistic group member might decide to mine at a loss just to help protect the network, as any additional hash counts. Mining can also be useful in collecting Ether without having to invest directly in the commodity.

Unconventional use for home mining is a cheaper method of heating. Mining machines turn power into crypto-monetary power and gas—even if the crypto-monetary cost is smaller than that of oil, heat itself may help people living in colder climates.

Is it profitable to mine Ethereum?

Whether any kind of mining is profitable depends entirely on the cost of electricity in any given region. As a guideline, something below $0.12 per kilowatt consumed per hour is likely to be sustainable, while rates below $0.06 are advised to allow mining a fully competitive economic enterprise.

These figures disqualify most home mining attempts, especially in developed countries with electricity normal higher than $0.20. While it could be possible to make a profit at those rates, the return on capital will be seriously affected. For example, a miner that spends $3,000 earns $200 per month in sales and consumes $45 in electricity at $0.05 per kWh would take 19 months to repay himself. The same miner used in an environment where power costs $0.20 per kWh will be repaid in 150 months or more than 12 years.

Skilled miners may gain an edge by shifting their activities to regions with the cheapest power or by taking advantage of the usually lower prices reserved for industries. These are some of the key reasons why mining has become a serious and capital-intensive industry.

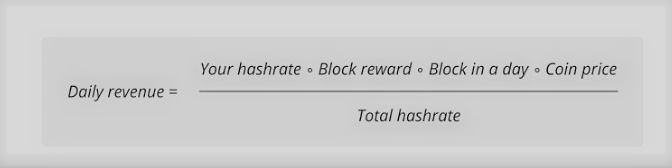

But mining Ether at home is still accessible to everyone, particularly because it can be done with consumer graphics cards produced by AMD and Nvidia. Miners living in areas with low energy costs can also become a good source of income. Several calculators can outline what gains can be expected, such as Miningbenchmark.net, Whattomine, or the CryptoCompare calculator. These quantities can also be determined separately. The formula used by the websites of the calculator is very simple:

This gives an estimation of how much a miner is supposed to do in a day. In essence, the profits of the miner are the overall network issuance compounded by their share of the total network hash rate. To make a return, the cost of energy consumed by the miner must be subtracted. For example, a system that uses 1.5 kWh of electricity for $0.10 would cost $3.6 per day.

The values to be used in the sales calculation can also be found online. Etherscan can have an accurate estimation of the overall hash rate, as well as block times and block incentives. On the Ethereum network, the current block times are 15 seconds, meaning there are 5,760 blocks a day, and the reward is 2 ETH per block as of October 2020. The miner’s hash rate relies solely on mining hardware, while the network hash rate is the sum of all miners connecting to the network.

The trick to effective mining is to optimize the hash rate while minimizing the cost of energy and hardware. In addition to location, therefore the option of mining hardware is critical for mining.

Can we predict Ethereum’s future in 2021?

Trading Beasts has a much more optimistic forecast for 2021, also predicting a potential price of $503,651 by December. But overall, the growth it expects is sluggish and steady. Its most conservative forecasts place ETH at $342.483 by the end of 2021, which is smaller than its current price of $387.09.

These predictions could be unfairly bearish. According to the LongForecast, Ethereum is in for a brighter future. Although it forecasts that ETH will close the year 2020 at a disappointing $369, it expects growth to be encouraging across 2021, reaching a peak of $710 in August before finishing at $538 by the end of December 2021.

This is good.

Great news